Markets on Hold: S&P 500 Sets New Record and Economic Uncertainty

US stocks edged higher on Wednesday, with the S&P 500 hitting a new all-time high for the second day in a row. Investors were paying close attention to the minutes of the Federal Reserve's January meeting and pondering President Donald Trump's latest tariff initiatives. As a result, all three key Wall Street indices ended the day higher.

Fed Keeps Rates On Hold, But Predicts Economic Slowdown

The Fed decided to leave its benchmark interest rate unchanged in January, but the published minutes voiced concerns about low inflation and the possible impact of Trump's economic policies, in particular new tariffs, on the regulator's plans.

According to Paul Nolte, senior adviser to wealth management at Murphy & Sylvest, the Fed does not rule out the possibility that the US economy may slow down in the future. "Investors are starting to count on a rate cut in the long term," he noted. However, according to the expert, the Federal Reserve is still taking a wait-and-see attitude and will not take drastic steps until it receives more information about the consequences of the White House's trade decisions.

Trump's Tariff Policy: A Real Threat or a Game of Nerves?

On Tuesday, Donald Trump announced his intention to impose tariffs "in the region of 25%" on automobiles, semiconductor products and pharmaceuticals. This statement became the latest link in a chain of trade initiatives that are causing concern among market participants and analysts.

However, Nolte notes that investors are taking the tariff threats with a grain of salt. "It feels like it's more of a tactical move than a real threat. So far, we've seen more words than action," he said.

As a result, markets remain in limbo, balancing expectations of an economic slowdown, a possible Fed rate cut, and uncertainty about U.S. trade policy.

Construction activity falls, indices rise, and corporate turmoil

U.S. stock markets ended the day with modest gains despite worrying housing data and sharp moves in the corporate sector.

Construction activity slows amid high mortgage rates and bad weather

Housing starts fell 9.8% in January, according to the Commerce Department. Experts attribute this to weakening consumer demand, high mortgage rates, and bad weather.

The housing sector index (.HGX) was the worst performer among sectors on the news, falling 1.5%. Investors are concerned that expensive credit and economic uncertainty could continue to weigh on the housing market.

Stock indices rise, but sectors show mixed dynamics

Despite worrying signs in the construction sector, U.S. stock indices ended the day in positive territory:

- The Dow Jones Industrial Average (.DJI) added 71.25 points (+0.16%), closing at 44,627.59;

- The S&P 500 (.SPX) rose 14.57 points (+0.24%) to reach 6,144.15;

- The Nasdaq Composite (.IXIC) showed a modest gain of 14.99 points (+0.07%), registering 20,056.25.

Healthcare (.SPXHC) led the gains among the 11 key S&P 500 sectors, while materials (.SPLRCM) and financials (.SPSY) were among the worst performers.

Company Earnings Beat Expectations

The fourth-quarter earnings season is winding down, and most companies have beaten analysts' expectations. According to LSEG, 74% of S&P 500 companies have reported better-than-expected results.

Analysts now expect S&P 500 earnings to increase 15.3% year over year, well above their initial forecast of 9.6%. That gain could bolster investor confidence and support a further rally in the stock market.

Corporate turmoil: Nikola collapses, Celanese disappoints

Amid the overall market rally, individual companies have faced serious problems.

Electric truck maker Nikola (NKLA.O) has plunged 39.1% after filing for Chapter 11 bankruptcy. The move is the culmination of a difficult period for the company, which has been struggling with a lack of capital and production problems.

Chemical company Celanese (CE.N) has fallen 21.5% after reporting a weak quarterly report, posting a loss that has disappointed investors.

The market continues to balance positive earnings, earnings growth prospects and macroeconomic challenges. Investors are closely monitoring the actions of the Federal Reserve, interest rate dynamics and the impact of U.S. trade policy. Macroeconomic indicators and further developments in the corporate sector will take center stage in the coming weeks.

Shift4 Shares Slip, Analog Devices Gains, Tariff Threat Volatility

Stock markets continue to be volatile amid corporate news and geopolitical tensions, as investors weigh the impact of new deals, tariff threats, and currency market volatility.

Shift4 Slips After $2.5 Billion Deal

Shift4 (FOUR.N) shares fell 17.5% after reporting its fourth-quarter earnings and announcing its $2.5 billion acquisition of Global Blue (GB.N). Investors were wary of the deal, which would require significant capital expenditures and could impact the company's future profitability.

Global Blue, meanwhile, surged 17.5%, reflecting positive market reaction to the acquisition and the potential for further growth within a larger entity.

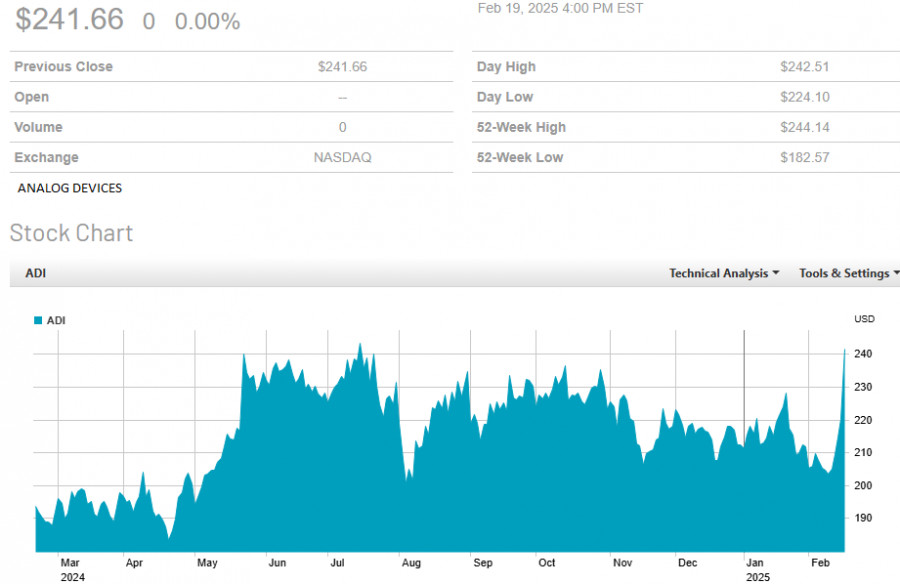

Analog Devices Pleases Investors

Amid volatile market sentiment, Analog Devices (ADI.O) was among the winners of the day. The company's shares jumped 9.7% after reporting strong financial results. Net income and revenue beat analysts' expectations, bolstering investor confidence in the business's resilience.

Global Markets: Caution and Flight to Safe Havens

US tariff policy and geopolitical factors continue to weigh on stock markets. A wave of negative headlines led to a decline in quotes in Asian trading sessions and also contributed to an increase in demand for safe havens:

- Gold reached a new all-time high, indicating increased investor nervousness;

- The Japanese yen strengthened to a two-month high, which also signals a shift of capital to traditional "safe havens".

European exchanges prepare for a cautious session

European index futures point to weak dynamics on Thursday. This comes as the pan-European STOXX 600 index (.STOXX) lost almost 1% overnight, its sharpest daily drop in two months. Investors are worried that economic uncertainty and tariff threats will continue to weigh on markets.

Yen strengthens amid expectations of BOJ action

The Japanese currency continues to rise, driven by two key factors:

- Increased demand for safe havens amid market volatility;

- The likelihood of the Bank of Japan raising interest rates, making the yen more attractive to investors.

The yen is currently at 150.48 per dollar, its strongest level since early December.

Stock markets remain in a state of heightened turbulence. While some companies are posting strong results, others are facing sharp declines due to corporate decisions. US tariff policy, geopolitical risks and currency fluctuations are adding pressure, forcing investors to act cautiously and seek safer assets.

Gold Continues to Shine: New Record, $3,000 Price Projected

The price of gold has once again reached a new all-time high, confirming its status as the main safe haven asset in the face of market turbulence. The precious metal has already gained 12% in 2025, continuing its impressive growth after a 27% jump last year, which was the strongest in the last ten years.

For investors who closely follow the market, this is the ninth time this year that gold has set a new record. The main drivers of growth are high geopolitical tensions, instability in stock markets and active demand from central banks.

The bullish sentiment of analysts from major investment banks is only fueling interest in gold. This month, Citi and Goldman Sachs raised their forecasts, predicting that the price per troy ounce could exceed $3,000.

The key factor fueling demand is buying by central banks, which continue to build up reserves of the precious metal, preferring it to unstable currencies. In the context of global uncertainty, gold remains the only asset that truly justifies its "safe haven" status.

European automakers under pressure: Mercedes-Benz and Renault earnings

This week, investors' attention is also riveted on the financial results of Mercedes-Benz (MBGn.DE) and Renault (RENA.PA). The European auto giants will try to calm the market and dispel fears about the impact of tariff barriers on their business.

US trade policy, especially regarding the auto sector, is causing concern among manufacturers. Investors are awaiting comments from company management on the possible impact of the new tariffs and their strategies for adapting to the changing conditions.

Markets continue to show contrasting sentiments: on the one hand, gold is storming new heights, attracting capital, on the other, industrial giants such as automakers are facing challenges related to trade wars.

In the coming days, gold dynamics and the results of earnings reports from key players may set the tone for further market movements.