Analysis of Trades and Trading Tips for the Japanese Yen

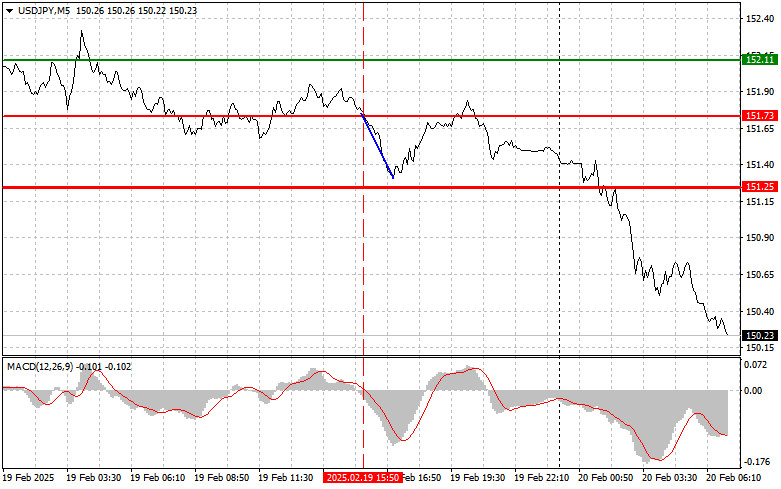

The price test at 151.73 occurred when the MACD indicator began to move downward from the zero mark, confirming a valid sell signal for the U.S. dollar. Consequently, the currency pair declined by more than 50 pips.

The yen has reached its highest level against the dollar since December of last year, outperforming all major currencies amid increasing speculation that the Bank of Japan will eventually raise interest rates. The Japanese currency appreciated by 0.8%, reaching 150.21 against the dollar, a level not seen since December 9. Currently, traders assign an 83% probability of a rate hike at the BOJ's July meeting, up from around 70% at the beginning of this month. Furthermore, a 100% chance of a rate hike is deemed inevitable by September.

Investors will continue to monitor signals from the BOJ regarding its future policy actions closely. Recent statements from central bank officials indicate a growing willingness to raise rates in light of persistent inflationary pressures and positive trends in wage growth.

However, a stronger yen could pressure Japanese exporters, making their products less competitive on the global market. On the other hand, a stronger national currency could help reduce import costs and curb inflation. The future trajectory of the yen will depend on BOJ's decisions and the overall economic situation in Japan.

As for the intraday strategy, I will primarily rely on implementing Scenarios #1 and #2 today.

Buy Signal

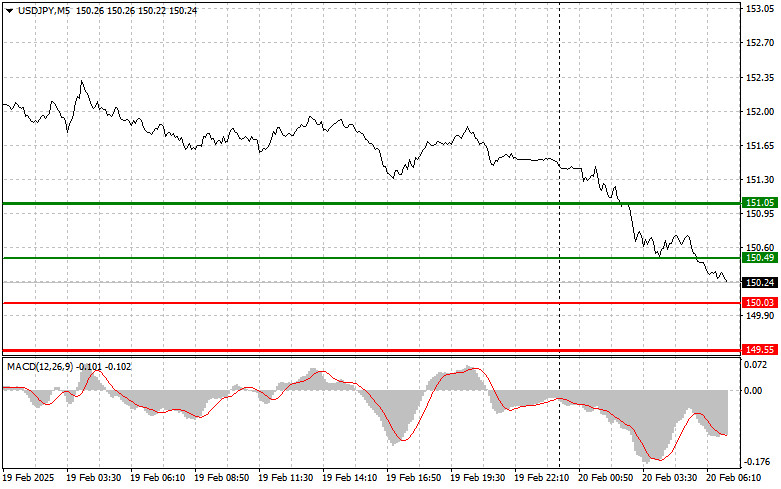

Scenario #1: Today, I plan to buy USD/JPY when the price reaches 150.49 (green line on the chart) with a target of 151.05. At 151.05, I will exit long positions and open sell trades in the opposite direction, expecting a 30-35 pip pullback. It is best to re-enter long positions on corrections and significant dips in USD/JPY. Important! Before entering a buy trade, ensure that the MACD indicator is above the zero mark and starting to rise.

Scenario #2: I will also buy USD/JPY today if the price tests 150.03 twice while the MACD indicator is in the oversold zone. This will limit the pair's downside potential and likely trigger a reversal to the upside. The expected upside targets are 150.49 and 151.05.

Sell Signal

Scenario #1: I plan to sell USD/JPY only after breaking below 150.03 (red line on the chart), which will lead to a rapid decline in the pair. The key target for sellers will be 149.55, at which point I will exit short positions and immediately buy in the opposite direction, expecting a 20-25 pip pullback. Important! Before entering a sell trade, ensure that the MACD indicator is below the zero mark and starting to decline.

Scenario #2: I will also sell USD/JPY today if the price tests 150.49 twice while the MACD indicator is in the overbought zone. This will limit the pair's upside potential and likely trigger a reversal downward. The expected downside targets are 150.03 and 149.55.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.The thin red line represents the entry price where the trading instrument can be sold.The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.