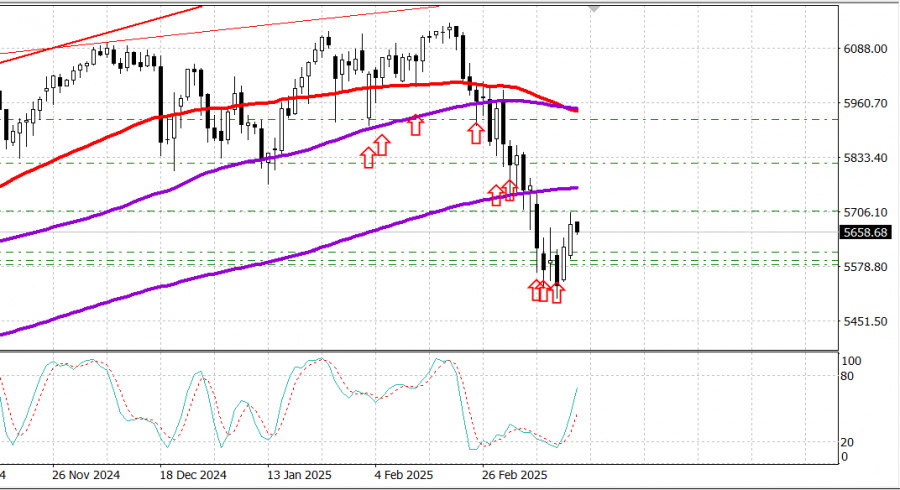

S&P500

US stock market: two days of gains from support levels

Snapshot of major US indices on Monday:

- Dow Jones: +0.9%

- NASDAQ: +0.3%

- S&P 500: +0.6% (closed at 5,675; range: 5,500 – 6,000)

Monday's trading session maintained a positive bias throughout the day. Investors stuck to the "buy-the-dip" strategy after the S&P 500 entered correction territory last week.

Losses in mega-cap stocks initially weighed on the index's performance, but broader market participation signaled stronger buying interest beneath the surface.

Advancers outpaced decliners by 4 to 1 on the NYSE. On Nasdaq, the ratio was 5 to 2. Buying activity accelerated across multiple sectors throughout the session, pushing the major indices to session highs. This followed a Bloomberg report suggesting that newly appointed US Trade Representative Greer aims for a more structured approach to the implementation of reciprocal tariffs on April 2.

The market rebound was also supported by recoveries in key mega-cap stocks:

- Apple (AAPL 214.00, +0.51, +0.2%) recovered after falling 1.6% intraday.

- Microsoft (MSFT 388.70, +0.14, +0.04%) bounced back after dropping 0.8% to its session low.

These two stocks account for 13% of the S&P 500's total market capitalization.

Wall Street is alert to pending economic data. Investors closely monitored economic data released in the morning, including:

- Retail sales for February, which came in weaker than expected.

- The New York Fed's March Manufacturing Survey indicated a decline in business activity, along with rising input and output prices.

Retail control group sales (excluding autos, gasoline, building materials, and food services) rose 1.0%, showing resilience in core spending.

Sector performance: 10 of 11 S&P 500 sectors finished higher

Energy (+1.7%) led the gains, supported by higher oil prices (WTI crude: $67.58 per barrel, +0.39, +0.6%)

Oil prices climbed on renewed geopolitical tensions in the Middle East after President Trump warned Iran that further Houthi rebel attacks on US ships would be seen as Iran-backed aggression.

Middle East instability continues to drive oil price gains amid supply concerns.

Treasury Yields and Fixed Income Markets

Treasury yields fluctuated as stock buying intensified.

- The 10-year U.S. Treasury yield ended the session unchanged at 4.31%.

- The 2-year Treasury yield rose three basis points to 4.05%.

Year-to-date performance of major indices:

- Dow Jones: -1.7%

- S&P 500: -3.5%

- S&P Midcap 400: -4.8%

- Nasdaq Composite: -7.8%

- Russell 2000: -7.3%

- February Retail Sales Report:

Economic calendar on March 17

Retail sales: +0.2% month-over-month (consensus: +0.7%)

January retail sales revised lower to -1.2% (previously -0.9%)

Excluding autos, retail sales: +0.3% (consensus: +0.4%)

Retail control group sales: +1.0% (strong recovery after -1.0% decline in January)

Takeaway: The strong rebound in core retail sales eased concerns about a potential GDP contraction in Q1.

- New York Fed's March Manufacturing Survey:

- General Business Conditions Index: Dropped to -20.0 (from 5.7 in February)

- Prices Paid Index: Rose five points to 44.9 (highest in over two years)Prices Received Index: Increased three points to 22.4 (highest since May 2023)

- Business Inventories (January):

- +0.3% MoM (in line with expectations), December: -0.2% MoM

- NAHB Housing Market Index (March): dropped to 39 (consensus: 43, previous: 42)

Key Insight: The survey reinforced concerns about stagflation risks entering the market.

Economic calendar on March 18

8:30 AM ET:

- Housing starts (February) (consensus: 1.385M, previous: 1.366M)

- Building permits (consensus: 1.450M, previous: 1.483M)

- Import prices (February) (previous: +0.3%)

- Export prices (previous: +1.3%)

- Industrial production (February) (consensus: +0.2%, previous: +0.5%)

- Capacity utilization (consensus: 77.7%, previous: 77.8%)

Ex-oil import prices (previous: +0.1%)

Ex-agriculture export prices (previous: +1.5%)

9:15 AM ET:

Energy markets:

Brent crude: $71.40 per barrel (failed to follow WTI higher)

Oil remains under pressure amid U.S. economic slowdown fears and weaker demand outlook

Final takeaway:

The US stock market confirmed strong support levels, reinforcing a buy-the-dip strategy. It makes sense to hold long positions from key support levels remains justified. If a notable pullback occurs today or tomorrow on the daily S&P 500 chart, adding to positions could be a reasonable strategy—provided capital is available.