Analysis of Trades and Trading Tips for the Euro

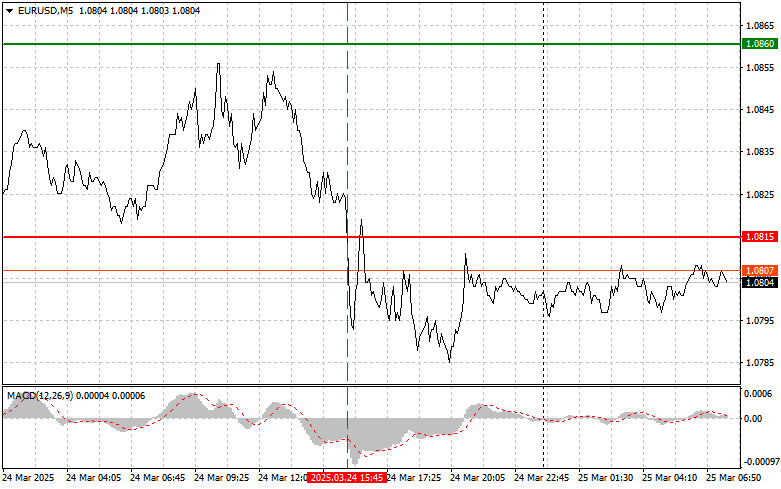

The test of the 1.0815 level occurred when the MACD indicator had already moved significantly below the zero mark, which limited the pair's downside potential. For this reason, I did not sell the euro. I also did not see any other valid entry points.

Demand for the dollar returned in the second half of the day, even though the U.S. economy showed mixed signals: the services sector is experiencing a strong upswing, while the manufacturing sector, on the contrary, is facing a downturn. The Manufacturing PMI has fallen below the critical 50 mark, indicating a negative outlook for the economy. This creates a mixed impression of the current state of the U.S. economy. Steady growth in services indicates strong consumer demand and overall economic activity, while the decline in manufacturing may signal weakening global demand, supply chain disruptions, or the impact of high interest rates. The divergence between these two sectors could also reflect structural shifts in the U.S. economy, where services are increasingly dominant. Over the coming months, the key question will be whether this trend will continue or whether the manufacturing sector will recover. The answer will significantly affect U.S. growth prospects and the dollar's strength.

Today, the IFO Business Climate Index, Current Conditions Index, and Expectations Index from Germany are expected. Traders closely watch these indicators as they are important barometers of Germany's economic health. Positive IFO results could boost confidence in the recovery of the German economy and increase the euro's appeal. On the other hand, weak data could spark concerns over slowing growth and pressure on the euro.

For intraday strategy, I will focus primarily on implementing Scenarios #1 and #2.

Buy Signal

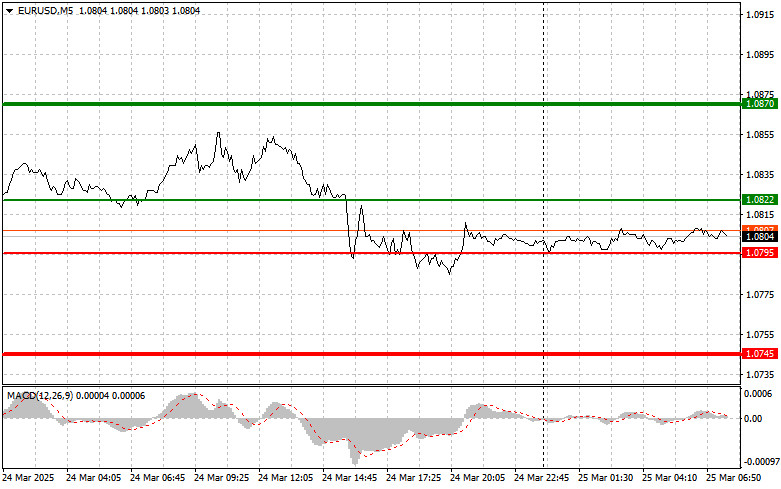

Scenario #1: I plan to buy the euro today upon reaching the 1.0822 area (green line on the chart), targeting a rise to 1.0870. At the 1.0870 mark, I intend to exit the market and sell the euro in the opposite direction, expecting a 30–35 pip move from the entry point. A bullish outlook for the euro in the first half of the day is valid only if the data is strong. Important: Before buying, ensure the MACD indicator is above the zero line and beginning to rise.

Scenario #2: I also plan to buy the euro today if there are two consecutive tests of the 1.0795 level when the MACD is in the oversold zone. This will limit the pair's downside potential and trigger an upward reversal. A rise toward the opposite levels of 1.0822 and 1.0870 can be expected.

Sell Signal

Scenario #1: I plan to sell the euro after reaching the 1.0795 level (red line on the chart). The target will be 1.0745, where I plan to exit the market and buy immediately in the opposite direction, expecting a 20–25 pip move from the level. Selling pressure on the pair will likely return if the data disappoints. Important: Before selling, ensure the MACD indicator is below the zero line and just beginning to decline.

Scenario #2: I also plan to sell the euro today if there are two consecutive tests of the 1.0822 level while the MACD is in the overbought zone. This will limit the pair's upside potential and trigger a downward reversal. A drop toward the opposite levels of 1.0795 and 1.0745 can be expected.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.