Benjamin Graham

Benjamin Graham, an American investor and economist, left a profound mark on financial history. His career peaked during the 1930s and 1940s, when he developed the principles of value investing, focusing on undervalued assets. Graham’s methods helped him and his associates, including Warren Buffett, amass enormous wealth. His strategies are detailed in his classic book, The Intelligent Investor, first published in 1949, which remains one of the most influential works on value investing to this day.

John Templeton

Sir John Templeton, a British-born investor who built his career in the US, became a pioneer of global investing. His success came in the mid-20th century when he bought stocks in overlooked markets. On the eve of World War II, he purchased hundreds of stocks at rock-bottom prices, which later brought him substantial wealth. His long-term investment philosophy is thoroughly presented in the book The Templeton Way: The Investment Strategies of John Templeton.

Thomas Rowe Price Jr.

Thomas Rowe Price Jr., known as the father of growth investing, founded T. Rowe Price Associates and championed the strategy of investing in high-potential growth companies. His career peaked in the mid-20th century when he focused on recognizing companies with strong growth prospects rather than undervalued stocks. Price outlined his key principles in various articles and analytical publications during his active years in the investment industry.

John Neff

American investor John Neff earned his reputation during the second half of the 20th century by managing the Windsor Fund for over 30 years. Under his leadership, the fund consistently outperformed the market, delivering impressive annual returns. Unlike many peers, Neff opted for low P/E stocks, focusing on stable growth rather than speculation. His investment approach is detailed in the book John Neff on Investing, where he shares his strategies for selecting promising assets and managing risks.

Jesse Livermore

Jesse Livermore, an iconic American trader, rose to fame in the early 20th century for his speculative strategies, earning fortunes during market crashes. He famously predicted and profited from the crashes of 1907 and 1929, accumulating immense wealth during the Great Depression. Livermore’s trading principles are immortalized in the classic book Reminiscences of a Stock Operator, a semi-autobiographical account based on his life and experiences.

Peter Lynch

Peter Lynch, one of the greatest American investors, gained fame for his extraordinary management of the Fidelity Magellan Fund from 1977 to 1990, during which the fund’s assets swelled from $18 million to $14 billion. Lynch was a proponent of investing in companies with simple, understandable business models and popularized the principle: “Buy what you know.” His insights and methods are detailed in his renowned books, One Up on Wall Street and Beating the Street, where he shares practical strategies for identifying lucrative companies.

George Soros

George Soros, a Hungarian-born American financier, became legendary for his bold speculative trades. He entered financial history in 1992, earning approximately $1 billion from a single bet against the British pound—a move that earned him the title "The Man Who Broke the Bank of England." Soros is known for applying the concept of reflexivity, analyzing how market sentiments affect prices. His theories and market insights are thoroughly discussed in his book The Alchemy of Finance, where he presents his unique approach to investing and market behavior.

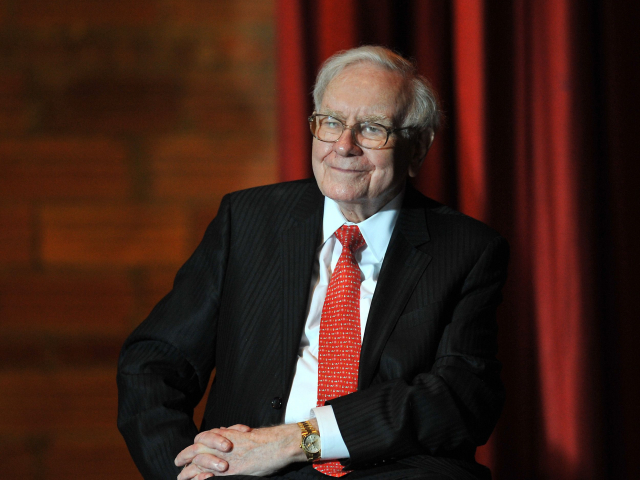

Warren Buffett

Warren Buffett, often called the "Oracle of Omaha," is one of the greatest investors in history, renowned for his ability to identify undervalued companies. Since 1965, he has led Berkshire Hathaway, transforming it into a global investment powerhouse. Buffett follows the value investing principles taught by his mentor Benjamin Graham, and avoids short-term speculation. His philosophy is extensively discussed in his annual letters to shareholders and in the book The Snowball: Warren Buffett and the Business of Life.

John Bogle

John Bogle, the founder of Vanguard Group, revolutionized investing by creating the first index fund in the 1970s, making passive investing accessible to the masses. Bogle’s strategy focused on minimizing costs and following the market rather than trying to beat it. A staunch advocate for long-term, low-cost investing, he promoted simplicity and discipline in investing, principles he thoroughly explained in his book The Little Book of Common Sense Investing.

Carl Icahn

Carl Icahn, an American investor and corporate raider, became famous in the 1980s for his aggressive activist investing tactics. He specialized in acquiring large stakes in companies to influence management and increase shareholder value. One of his most famous deals was the hostile takeover of TWA, which earned him significant profits. Icahn is known for his tough management approach and commitment to shareholder activism. His investment strategies are detailed in the book Icahn: The Restless Billionaire, where he shares insights into his approach to corporate takeovers and market influence.

-

Grand Choice

Contest by

InstaForexInstaForex always strives to help you

fulfill your biggest dreams.JOIN CONTEST -

Chancy DepositDeposit your account with $3,000 and get $6000 more!

In December we raffle $6000 within the Chancy Deposit campaign!

Get a chance to win by depositing $3,000 to a trading account. Having fulfilled this condition, you become a campaign participant.JOIN CONTEST -

Trade Wise, Win DeviceTop up your account with at least $500, sign up for the contest, and get a chance to win mobile devices.JOIN CONTEST

726

726 10

10