Analysis of Trades and Trading Tips for the Euro

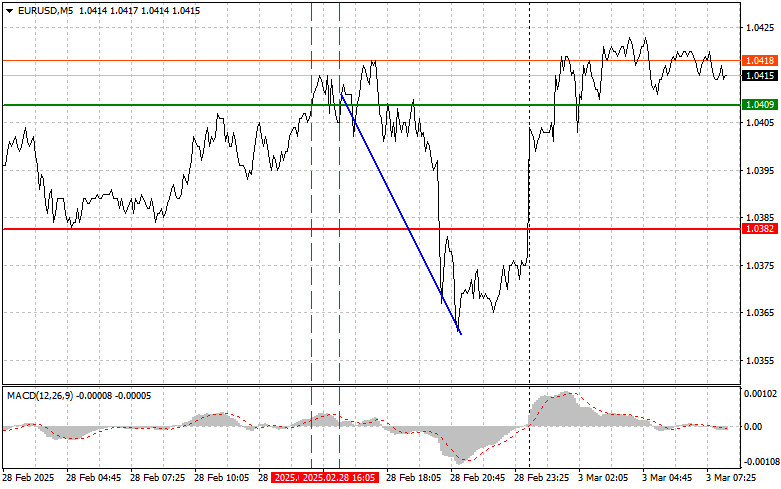

The first test of the 1.0409 price level occurred when the MACD indicator had already moved significantly above the zero mark, which limited the pair's upside potential. For this reason, I did not buy the euro. The second test of 1.0409, when the MACD was in the overbought area, triggered Scenario #2 for selling, resulting in a drop of more than 40 pips.

During the Asian session today, the euro showed an increase, opening higher against the dollar. This gain followed intensified support from European leaders for Ukraine, in contrast to last week's unsuccessful meeting between Trump and Zelensky. The market interpreted this as a sign of strengthening political stability in Europe, which reduced demand for the dollar as a safe-haven asset.

Despite the current trend, potential risks for the euro remain. Geopolitical uncertainty and trade disputes continue to negatively impact the region's economy. The eurozone's manufacturing sector remains under pressure, with high energy prices and overall global economic uncertainty undermining business and consumer confidence. If today's PMI data is worse than expected, the euro may face additional downside risks.

Besides the manufacturing PMI reports, several other key economic indicators will be released today. Particular attention should be paid to eurozone inflation data, which remains at a high level. The European Central Bank will closely monitor this data to determine whether further monetary easing is necessary. If inflation is higher than expected, the ECB may be forced to keep interest rates unchanged this Thursday. On the other hand, if inflation starts to decline, the ECB may have more room for maneuver and consider rate cuts.

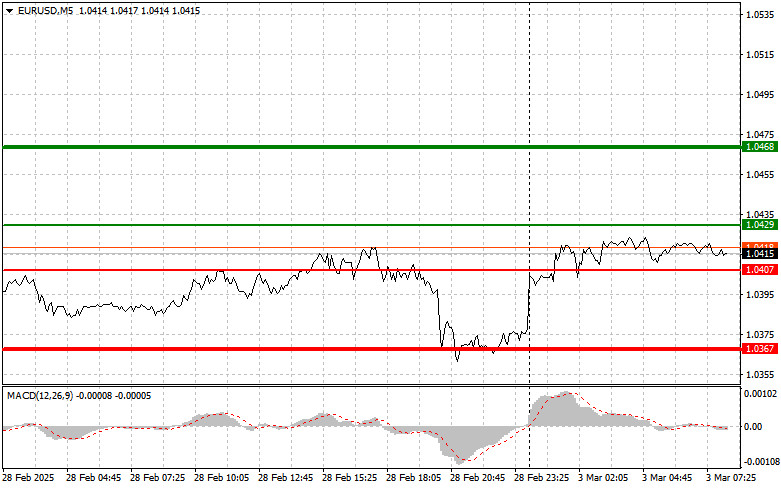

For intraday strategy, I will focus more on implementing Scenarios #1 and #2.

Buy Signal

Scenario #1: Buying the euro is an option if the price reaches 1.0429 (green line on the chart) with a target of 1.0468. I plan to exit the market at 1.0468 and initiate a sell trade in the opposite direction, aiming for a 30-35 pip move from the entry level. A euro rally in the first half of the day is only likely if we see strong economic data from Germany, France, and the eurozone. Important: Before buying, ensure that the MACD indicator is above the zero mark and just beginning to rise.

Scenario #2: Another buying opportunity will arise if the price tests 1.0407 twice while the MACD indicator is in the oversold area. This would limit the pair's downside potential and lead to a reversal to the upside, with expected growth toward the 1.0429 and 1.0468 levels.

Sell Signal

Scenario #1: Selling the euro is planned after reaching 1.0407 (red line on the chart), with a target of 1.0367. At this level, I will exit the market and immediately buy in the opposite direction, expecting a 20-25-pip move back up. Selling pressure may return if today's economic data is significantly worse than expected. Important: Before selling, ensure that MACD is below the zero mark and beginning to decline.

Scenario #2: Another selling opportunity arises if the price tests 1.0429 twice while MACD is in the overbought area. This would limit the pair's upside potential and lead to a market reversal downward, with expected declines to 1.0407 and 1.0367.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.