Trade Review and Tips for Trading the Euro

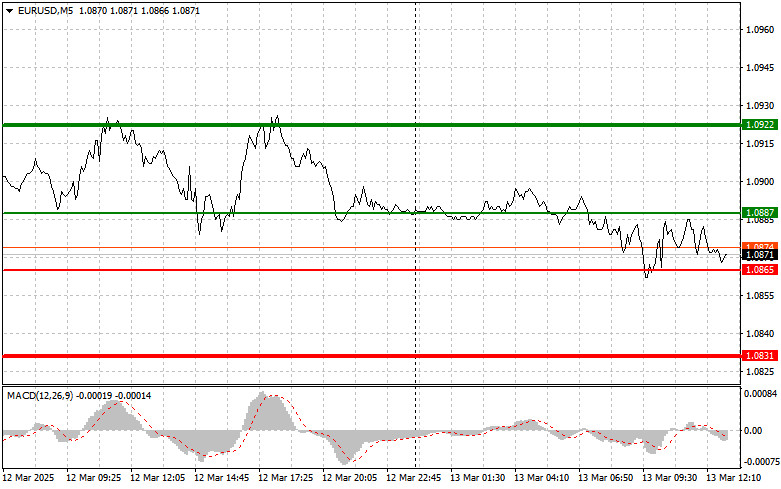

The price test at 1.0875 occurred when the MACD indicator had already moved significantly downward from the zero mark, which limited the pair's downward potential in such a bullish market. For this reason, I did not sell the euro. The second test of 1.0875 took place when the MACD indicator was already in the oversold area, allowing Scenario #2 for buying to materialize, but the pair failed to achieve substantial growth.

The market seems to have ignored both strong macroeconomic indicators and potential ECB signals, preferring to remain in a wait-and-see mode. This may be due to uncertainty regarding the Federal Reserve's future actions. Yesterday's weak euro growth is adding pressure on traders expecting the bullish market to continue, which, judging by the current situation, may be coming to an end.

The Producer Price Index (PPI), which is being released today in the U.S., is an important inflation indicator reflecting changes in prices received by producers for their goods. It is considered a leading inflation indicator. February's PPI data is expected to show a decline and provide insight into inflationary pressures in the manufacturing sector. Economists will closely monitor both the overall PPI and core PPI (excluding food and energy prices) to assess inflation's persistence and its potential impact on the Federal Reserve's future policy. If inflation comes in lower than expected, this could lead to a Fed rate cut in the near future, weakening the dollar. However, stronger-than-expected PPI figures may heighten inflation concerns and push the Fed toward a more aggressive rate stance.

Regarding intraday strategy, I will rely more on implementing Scenarios #1 and #2.

Buy Signal

Scenario #1: Today, I plan to buy the euro when the price reaches 1.0887 (green line on the chart), targeting a rise to 1.0922. At 1.0922, I plan to exit the market and also sell the euro in the opposite direction, aiming for a 30-35 point move from the entry point. A further euro rally today would be in line with the existing trend. Important! Before buying, make sure the MACD indicator is above the zero mark and just beginning to rise from it.

Scenario #2: I also plan to buy the euro today if the price tests 1.0865 twice in a row, while the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a reversal upward. A rise can be expected toward 1.0887 and 1.0922.

Sell Signal

Scenario #1: I plan to sell the euro after reaching 1.0865 (red line on the chart). The target will be 1.0831, where I intend to exit the market and immediately buy in the opposite direction, aiming for a 20-25 point rebound from this level. Selling pressure on the pair may return if U.S. inflation rises sharply. Important! Before selling, make sure the MACD indicator is below the zero mark and just beginning to decline from it.

Scenario #2: I also plan to sell the euro today if the price tests 1.0887 twice in a row, while the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a downward reversal. A decline can be expected toward 1.0865 and 1.0831.

Chart Explanation

- Thin green line – Entry price for buying the trading instrument.

- Thick green line – Expected price level where Take Profit orders can be placed or profits can be manually secured, as further growth above this level is unlikely.

- Thin red line – Entry price for selling the trading instrument.

- Thick red line – Expected price level where Take Profit orders can be placed or profits can be manually secured, as further decline below this level is unlikely.

- MACD Indicator – When entering the market, it is essential to consider overbought and oversold zones.

Important Notice for Beginner Traders

Forex market beginners should exercise caution when making entry decisions. Before the release of key fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during news releases, always use stop-loss orders to minimize potential losses. Without stop-loss protection, you could quickly lose your entire deposit, especially when trading with large volumes without proper money management.

Finally, a successful trading strategy requires a clear trading plan, like the one outlined above. Spontaneous trading decisions based on the current market situation are a losing strategy for intraday traders.