Analysis of Trades and Trading Tips for the Euro

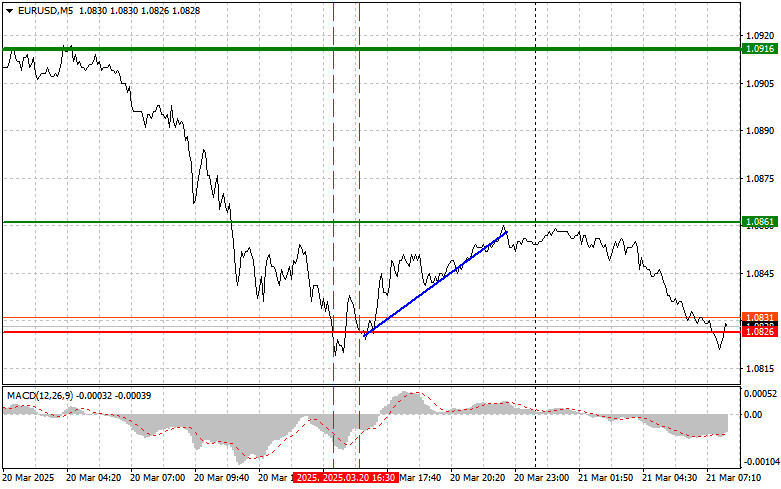

The price test at 1.0826 occurred when the MACD indicator had already moved significantly below the zero line, which limited the pair's downside potential. For this reason, I did not sell the euro. The second test of 1.0826, when the MACD was in oversold territory, led to the execution of Buy Scenario #2, resulting in a rise of more than 30 pips.

Yesterday's strong U.S. data on existing home sales and the labor market helped the dollar strengthen against the euro in the second half of the day. Investors interpreted these numbers as a sign of resilience in the U.S. economy, which has recently raised several concerns. The dollar's strength pressured the euro and allowed the correction to continue. Stable U.S. labor market data, in particular, suggest that inflation may remain more persistent than previously expected. This, in turn, gives the Federal Reserve more room to maneuver in monetary policy.

European Central Bank data on the current account balance and eurozone consumer confidence will be released today. Negative data could add further pressure to the euro, and the euro's reaction will depend on the degree to which the figures deviate from expectations. A significant deterioration could trigger a new wave of euro selling, while unexpectedly positive data could support the European currency.

For intraday strategy, I will primarily rely on Buy and Sell Scenarios #1 and #2.

Buy Signal

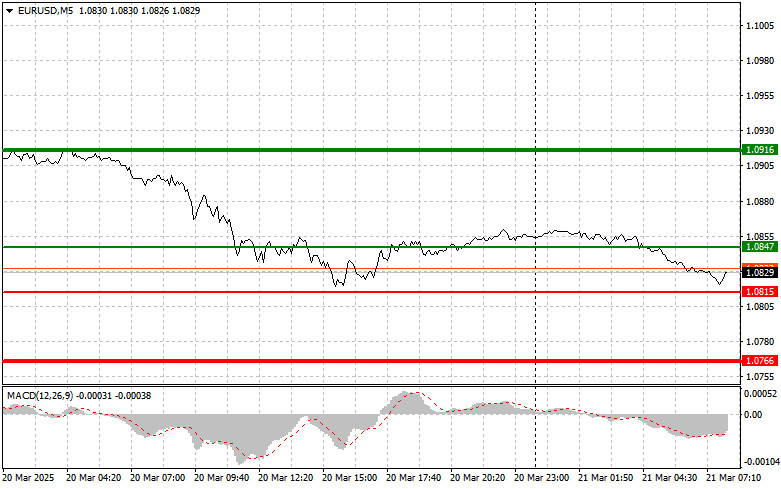

Scenario #1: I plan to buy the euro today if the price reaches around 1.0847 (green line on the chart), with a target of rising to 1.0916. At 1.0916, I will exit the market and consider selling the euro in the opposite direction, aiming for a 30–35 pip move from the entry point. A euro rally in the first half of the day is only likely if the statistics are strong. Important: before buying, ensure the MACD is above the zero line and just beginning to rise from it.

Scenario #2: I also plan to buy the euro if there are two consecutive tests of the 1.0815 price level while the MACD indicator is in oversold territory. This would limit the pair's downside potential and lead to a reversal to the upside. A rise toward the opposing levels of 1.0847 and 1.0916 can be expected.

Sell Signal

Scenario #1: I plan to sell the euro after the price reaches the 1.0815 level (red line on the chart), with a target at 1.0766, where I intend to exit the market and buy immediately in the opposite direction, targeting a 20–25 pip rebound. Downward pressure on the pair could return today if the data are weak. Important: before selling, ensure the MACD is below the zero line and beginning to decline.

Scenario #2: I also plan to sell the euro if there are two consecutive tests of the 1.0847 level while the MACD is in overbought territory. This would limit the pair's upside potential and trigger a downward reversal. A decline toward the opposing levels of 1.0815 and 1.0766 can be expected.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.